In 2024, student loan debts have once again reached all-time high records, a fact that surprises no one as it happens year after year. The average sum of debts by the end of 2023 was estimated to be more than $1.7 trillion.

Over the past few decades, the cost of college education has skyrocketed, making it increasingly unaffordable for many individuals. The rising costs of tuition, textbooks, and other expenses associated with college have far outpaced the rate of inflation and wage growth. As a result, students and their families are often forced to take on substantial debt to cover these expenses, leading to a lifetime burden of loan repayments.

It is a real-life common problem

According to recent statistics, approximately 45.3 million Americans currently have student loan debt. Each year, millions of students take out federal and private student loans to cover the rising costs of tuition, fees, and living expenses. In the last few years, about 62% of undergraduate students took out student loans, with an average loan amount of around $37,338 per borrower. For master’s degree students, the sum is already twice as high, at around $80,500.

It’s a never-ending story as well. According to the Initiative Data Report 2023, student loan borrowers still owe about $20,000 each even 20 years later. So, in their 40s, instead of having their own house and a stable financial state to support a family, people spend hundreds of dollars per month throughout their whole adult life.

- The average amount of student loan debt is about $1.7 trillion

- One in 8 Americans has student loan debt

- It takes more than 20 years to repay a student loan, and there is still $20,000 left

How does it affect youth’s mental health?

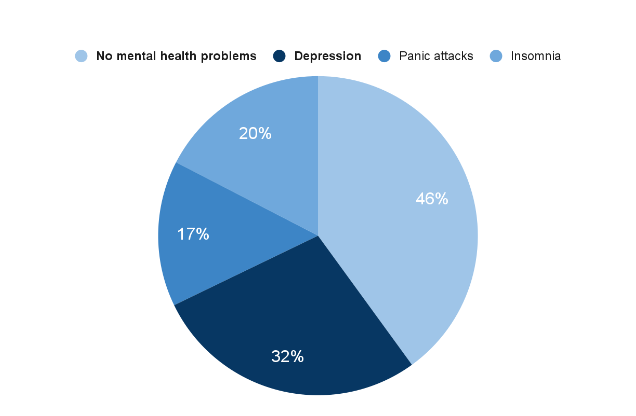

Mental well-being has been a significant concern, especially among young adults aged 20 to 24. According to the ELVTR report, about 54% of surveyed graduates report experiencing some form of mental health problem caused by their student loan debt. These problems can be divided into several categories:

- Pressure. It feels like you don’t have any free time; you have to find a well-paying job as soon as possible. While you’re unemployed, your debt keeps growing bigger and bigger. This overwhelming feeling is all that's on your mind.

- Regrets. 'I shouldn’t have taken out a loan; I should have chosen another major/university/program. I’ve spent too much time and money for nothing.' These are the typical thoughts graduates have when their job search takes too long.

- Lack of motivation. The transition from student life to work life can be stressful, as many aspects of your everyday routine change. It takes time to get used to the new environment. Moreover, the pressure to succeed and pay off student loans adds to the stress, making it difficult to find the motivation to excel in a new job.

- Hopelessness. With so many people living their best lives on the Internet, you can't help but feel like the only one falling behind.

- Anger. The fact that you now have a big debt to repay, while the degree that was supposed to be your winning card is not enough, can be infuriating.

Coping with everything at once is a difficult task, and for many, it's too difficult. According to the same report, 32% of recent grads have depression, and 17% have even had panic attacks.

The most frustrating thing is that your degree gives you no profit. The ELVTR survey found that 60% of people with degrees have a lower salary than their friends with no higher education attainment.

- 54% of surveyed graduates say they have experienced mental health issues due to student loan debts

- The most common reasons for depression among young adults are feelings of pressure, hopelessness, anger, lack of motivation, and regrets

- 60% of people with degrees report having a friend without a degree who earns more

How does it affect finances?

As we have already mentioned, the costs of higher education are unimaginable these days. Student loans have a lasting impact on an individual's finances, affecting their ability to achieve financial goals and build wealth over time. It’s simply hard to plan for the future.

If you go on Reddit or X, you will find hundreds of stories of people struggling to live their lives with a heavy burden to bear. There is one example I find particularly compelling:

‘Recently checked my loan balances since graduating in 2012 I have paid 75k in private student loans and guess what.... My balance is now $121,987. My original loan balance was between 89/90K for 4 1/2 years of college.’ - says one of the users.

The only thing they get is fighting to survive and supporting one another, because it feels easier when you know someone else is facing the same problem as you.

The most affected age groups are 25 to 34 and 35 to 49. Although the biggest number of borrowers is in the 25 to 34 group (15 million people), those aged 35 to 49 owe almost $1.5 billion more. This statistic indicates that debts grow faster than people are able to repay them, leaving you tied up for the rest of your life.

- Student loan debts affect borrowers’ quality of life

- The age groups 35 to 49 struggle the most

- Interest rates grow faster than people can repay

There is a debt but no work

Some people may say, ‘Fine, we get it. Just find a job and pay. What’s the problem? Doesn’t matter how much you get. Small salary is better than nothing anyway’. And they have a point. But there is another problem - there are no jobs for graduates.

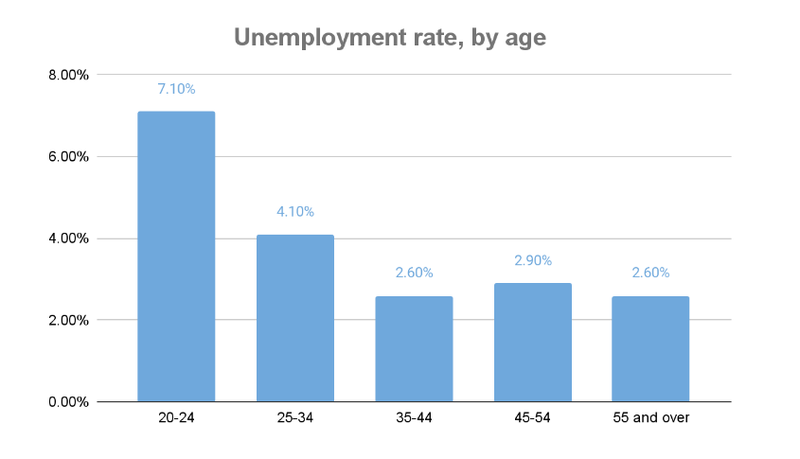

Although the overall unemployment rate is currently low, at about 3.8%, unemployment among young adults is almost twice as high, at 7.1%.

Recent studies show that employers find graduates unprepared for work and are reluctant to hire them. In fact, about two-thirds of surveyed employers claim that they would prefer to increase the salary for a job opening to avoid hiring graduates and to attract experienced workers.

Another survey shows that when given the choice between a recent graduate with a bachelor’s degree and a person with four years of relevant experience but no degree, 71% of employers would prefer the second option.

Seeing all these facts and being unemployed for several months, how would they feel? Would they be grateful for having their degree at such a huge cost? That’s the question.

- The unemployment rate among young adults is the highest

- Employers prefer experience over education

- Employers don’t think recent graduates are ready for work

Is paying for your education with a loan worth it?

It really depends. The statistics are unsatisfying; however, it’s only up to you to decide whether you are ready to take this step or not. Although, I still have some advice to share to help you.

Do you have time to save any money?

If you’re still in high school and are desperately willing to go to college, knowing that your parents can’t afford to pay for your education, find part-time work on weekends and during holidays. The money you earn can be saved directly for education-related expenses. Alternatively, you can make a deal with your parents: you work to earn your pocket money while they are in charge of saving for your degree. Either way, this will help you take out a smaller loan.

Will you be able to do part-time work while studying?

Another way to make your life easier in the future is to work hard in the present. There will be some unemployment right after graduation, while you’ll also have to repay loans. Having some savings from part-time jobs can really help you out. But think twice before relying on this advice, as studying and working at the same time may be too hard for some people.

Consider your household income.

We never know what surprises life has for us. There may be a situation where you’re unemployed or underemployed for half a year. Or you break your leg and cannot go to work for a long period of time. In these cases, it’s better to have people around you who can support you in times of need. Family is usually number one on the list. But even if your parents really want to help but don’t have money, there will be nothing they can do. So if you realize you can’t rely on them in this case, think of somebody else or take it as it is.

Is the field of study you want to pursue in-demand lately?

The worst thing that can happen to your degree is for it to become useless. When choosing a major, make sure you will be able to find a job in your field. The world is constantly changing, making it harder to predict anything. Check out recent trends in the industry: is it in-demand? Is there a danger that AI will replace some people's jobs? Do your research first.

Compare the cost of education with the average salary in your field.

This one is literally a comparison of expenses and income. How fast will you earn the exact amount of money you took out? Consider that your debt may grow faster than your salary as well. Check the information about average salaries in the field and future projections.

- It’s up to you to decide if a degree is worth paying for

- Seek part-time job opportunities to help you repay your loan

- Do research on the field when choosing a major and repayment options

So! Before taking out a student loan, it is important to assess your financial situation, research alternative funding options, and carefully consider the potential return on investment of your education. Additionally, understanding the terms of the loan, including interest rates and repayment options, is crucial for making an informed decision.

Ultimately, the value of a student loan depends on your personal circumstances and goals. By weighing the costs and benefits, and planning for repayment, you can make a more informed decision about whether taking out a student loan is the right choice for you.